Secret Factors You Must Required a Prenup Agreement Prior To Going Into a Marital Relationship Agreement

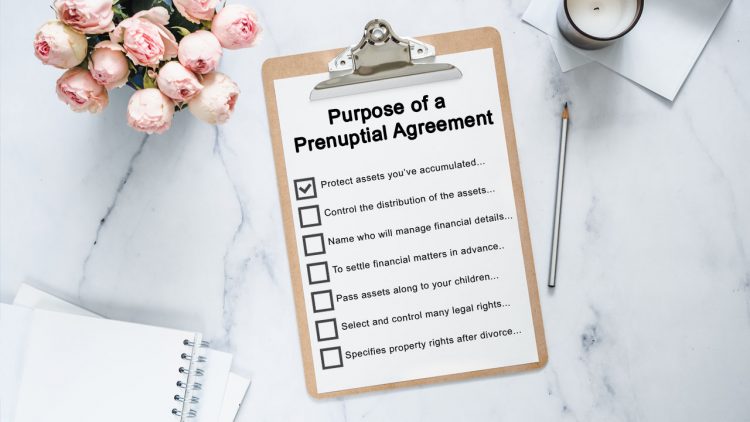

Comprehending the Fundamentals of a Prenuptial Arrangement

While lots of regard it as unromantic, a prenuptial agreement, or 'prenup', works as a functional device in the world of marital planning. This lawfully binding contract, commonly structured by spouses-to-be, details the division and circulation of properties and obligations in the occasion of separation or death. It's essential to understand that prenups aren't simply for the wealthy. Rather, they offer a transparent financial roadmap for couples, promoting open interaction about monetary issues and potentially averting disputes down the line. Despite its somewhat pessimistic facility, a prenuptial contract can dramatically reduce the stress and anxiety and uncertainty that often accompany divorce process, supplying a feeling of safety and control to both parties included.

Guarding Specific Possessions and Financial Obligations

To secure private assets and debts in a marriage, a prenuptial contract confirms to be a vital device. Furthermore, a prenuptial contract is crucial in shielding one from the other's financial obligations. Hence, a prenuptial agreement provides a safety internet, making sure economic implications of a possible breakup do not unfairly drawback either event.

Defense for Company Owner

For countless entrepreneur, a prenuptial agreement can be a crucial protective step. It safeguards companies from being divided or sold in case of a divorce. Whether it's a flourishing enterprise or an appealing startup, the owner's share remains intact. This defense expands past the owner to partners and shareholders, protecting against disturbance in organization useful link procedures. Even if one spouse bought the company throughout marital relationship, a well-crafted prenup can establish that the company isn't thought about marital property. It also ensures that the non-owner partner is relatively compensated without endangering business's stability. A prenuptial contract is not just an agreement between future partners; it can be seen as an insurance coverage policy for the business.

Exactly How Prenups Protect Future Inheritance and Estate Strategies

In the realm of future inheritance and estate strategies, prenuptial agreements offer as a crucial secure. These contracts can explicitly stipulate that particular assets, like an inheritance, ought to not be classified as marriage home. Hence, prenuptial contracts play a pivotal role in protecting future wealth and guaranteeing a person's financial stability (Prenuptial agreement Ontario).

Ensuring Family Members Assets and Interests

While prenuptial agreements are commonly checked out as a means to safeguard private wealth, they also serve an essential role in ensuring household properties and rate of interests. Hence, the inclusion of a prenuptial contract in a marital relationship contract can offer as a protective shield, preserving the honesty and security of household possessions and passions for future generations.

The Role of a Prenup in Clarifying Financial Obligations

Beyond protecting family members possessions, prenuptial contracts play a critical role in marking economic responsibilities go right here within a marriage. These agreements explicitly lay out which companion is accountable for particular financial responsibilities, eliminating any type of ambiguities that might develop during the marriage. They define who shoulders debts, pays bills, and takes care of financial investments. This quality can reduce potential disagreements, guaranteeing a smoother monetary journey for the couple. Cohabitation agreement Ontario. In the unfavorable event find more information of separation, a prenup can prevent bitter wrangling over financial obligations and properties, as it plainly demarcates what comes from whom. Thus, by clearing up financial duties, a prenuptial contract cultivates openness and trust, 2 keystones of a strong marriage partnership. Thus, it is not just a protective step, but a device promoting financial consistency.

Verdict

In final thought, a prenuptial agreement works as a protective shield for specific possessions, business interests, and future inheritances before entering a marital relationship agreement. It develops a clear financial atmosphere, reducing prospective conflicts and securing family members riches for future generations. It plays a crucial function in defining economic responsibilities, promoting healthy communication, and guaranteeing stability even when faced with unanticipated scenarios.

Comments on “A prenuptial agreement Ontario is crucial for safeguarding your financial future and inheritance.”